Spanish banking group Santander had suspicions over the activities of investment fraudster Bernie Madoff in 2006, internal documents have revealed.

The details emerged at a court in Miami where a class action lawsuit has been filed against the financial services provider.

According to the report, made by Optimal Investment Services, a Swiss division of the bank, the activities of Mr Madoff and his business were “shrouded in secrecy” while there was no independent assessment of trading processes in place.

Santander and its investors lost $3.2 billion in the fraud perpetrated by Mr Madoff.

In the report, Optimal said: “Madoff Securities is a privately-owned family business which ... increases the possibility of collusion."

However, the study concluded that “despite the above, we believe the organisation is efficiently and professionally managed”.

The case in Miami has been launched by a group of investors in Optimal, who claim the bank should have done more to protect them from Mr Madoff and his activities.

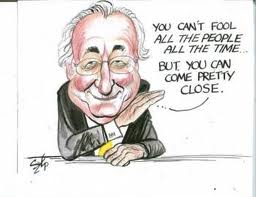

Bernie Madoff has been jailed for 150 years for heading up the Ponzi scheme, which cost investors an estimated total of $65 billion.

No comments:

Post a Comment